The Digital Partner for Modern Brokers

Digital systems that reduce broker admin and close more deals.

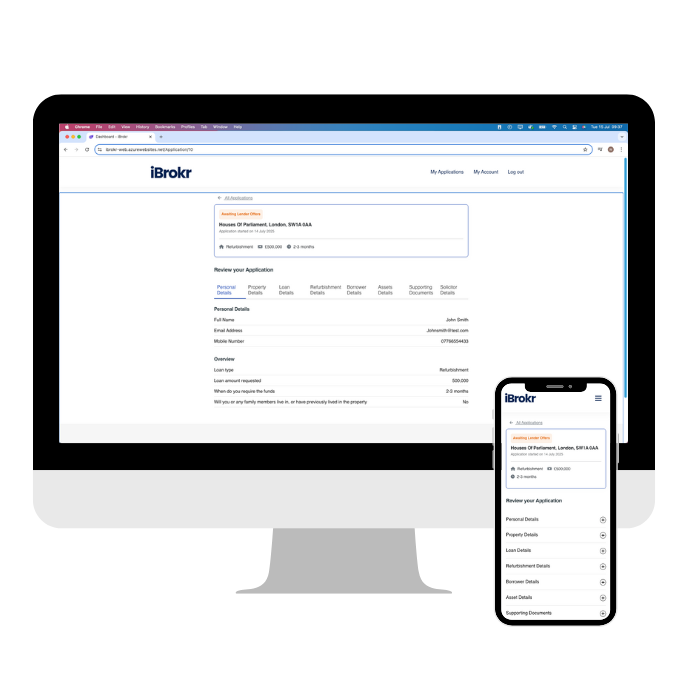

We’ve built a platform that cuts the admin and speeds up decision making. Tired of rekeying deals, sending borrower information over disjointed emails, and chasing lenders for a response? iBrokr allows the borrower to do the heavy lifting for you. Easily send fully-packaged cases to your preferred lenders and quickly compare full DIP offers side-to-side.

We'll collect:

Built for Brokers Who Value

Is this you?

How it Works.

Compliance & Transparency

You stay in control. We stay in the background.

Every deal is logged under your name, and your client remains your client. We never contact them directly unless you’ve asked us to and we don’t cross-sell, upsell or remarket behind your back.

Clear audit trails. No surprises.

All activity including submissions, messages, documents, and offer decisions are logged and time-stamped in the system, giving you and your lenders a fully transparent record.

Built for regulated and unregulated business.

Whether you’re working under FCA permissions or placing unregulated deals, our platform is designed to support your compliance responsibilities without creating extra admin.

GDPR Compliant

We are completely GDPR compliant and protect our borrowers accordingly. Check out our T&Cs and Privacy Policy.

Want to modernise your systems?

Reduce admin, generate business and complete more loans.